Business Loans Queensland Government

27 rows A government-backed business loan is a loan that the government provides a. 5000 grants will be made available to small and medium businesses across Queensland affected by the COVID-19 lockdown that commenced on Saturday 31 July 2021 and lockdowns in other states.

Business Loans Lending For Small To Large Business Nab

If you received the JobKeeper Payment between 4 January and 28 March 2021 you may be eligible to apply for a business loan.

Business loans queensland government. Any hidden charges or terms. First Start Loan - Commercial fisher. By getting involved with small business loans the Queensland government attempts to stimulate the local economy by offering the small business loans to qualified small Read Full Answer.

To buy your wild-catch fishing enterprise. A startup business might be able to get startup loans the Queensland government funding sources may offer. The Federal Government has launched the SME Recovery Loan Scheme.

View business loans at BOQ with different business finance options. 1200pm AEST on Monday 16 August 2021. Products are issued by Bank of Queensland Limited ABN 32 009 656 740 BOQ.

Guides to help your business. The various governments in Australia including the Queensland Read Full Answer. Support for lockdown-affected businesses.

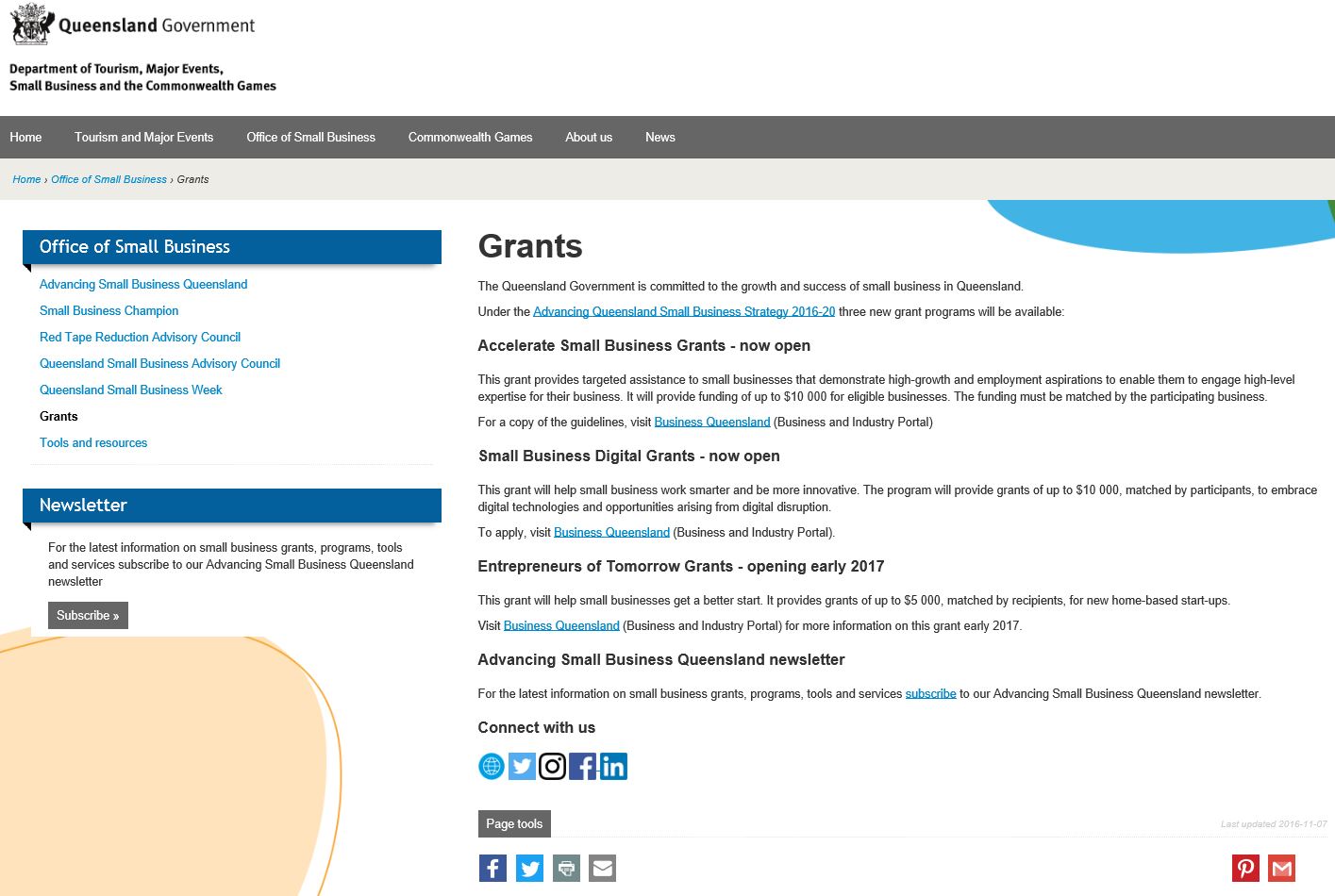

27 Zeilen New business loan customers can apply for loans under the scheme in the form of. We are providing opportunities for small businesses to collaborate and build on their innovation and ideas to help them grow and improve products and services and compete in a global market. Your business or not-for-profit organisation may be eligible for the 2021 COVID-19 Business Support Grants if youve been impacted by the Queensland lockdowns.

To become a partner in the family wild-catch fishing business. Find financial assistance eligibility and timing for the new government support for Australian businesses. Read about the 2021 COVID-19 Business Support Grants for eligible businesses and not-for-profit organisations that have been impacted by the South East Queensland Cairns and Yarrabah or any other Queensland lockdown in August 2021.

Non-employing sole traders may also be eligible. A start-up or an established business. Funding may be used.

There are 2 basic financing strategies. Your business or not-for-profit organisation may be eligible for a grant if youre impacted by the South East Queensland CairnsYarrabah or any other lockdown in August 2021. Loans are available from 1 April 2021 until 31 December 2021.

A three-year business loan of up to 250000 with a six-month deferral on repayments with interest capitalised. Each loan type will have different tax and GST implications. Our Advance Queensland programs and funds are listed below to help you find the support your need.

Choose a loan type for your business. Your business may be eligible for financial support through the 2021 COVID-19 Business Support Grants. Premier Annastacia Palaszczuk said the rapidly evolving impacts of the coronavirus demanded.

Well be updating this page as new information is available. Once you assess your needs you should examine which financial product is the right one for your business. Provides commercial fishers with low interest loans of up to 2 million to help in the early years of establishing a commercial wild-catch fishing enterprise.

International Freight Assistance Mechanism The IFAM is a temporary measure to help restore critical global supply chains which have been impacted by COVID-19 containment measures around the world. What you need finance for will determine the most suitable approach for your business. VET Student Loans is available to assist eligible students studying higher level vocational education and training qualifications to pay their tuition fees.

Applications for employing businesses opened 12pm midday 16 August 2021. The SME Recovery Loan Scheme builds on earlier loan schemes introduced during COVID-19. Use our coronavirus COVID-19 business assistance finder to find out what support you may be eligible for.

The Government will work with lenders to ensure that eligible firms will have access to finance to maintain and grow their businesses. Your stage of business development ie. SME Recovery Loan Scheme Business Loan.

You can search for information on government subsidised training on the Queensland Skills Gateway. Debt finance - borrowing funds that you pay back with interest within agreed time frames eg. Hospitality businesses must use the app from 1 May 2021.

If youre eligible to apply for a grant or program. Analyse the different loan options for. The Queensland government has announced today a new 500 million loan facility interest free for the first 12 months to support businesses and keep Queenslanders in work.

Business loans queensland government. You can also view Queensland Government and Australian Government support options. To achieve enterprise viability.

Applications are now open. Track the progress of your application via QRIDA by emailing contact_usqridaqldgovau or phoning 1800 623 946.

Business Loans Lending For Small To Large Business Nab

The Mesmerizing Capability Statement Examples Google Search Sample With Capability Statement Te Statement Template Word Template Mission Statement Template

Resources The Vanilla Muse Blogging Tips Writing Blog Posts Blogging For Beginners

New Stimulus Queensland Government Small Business Adaptation Grant Program 4front

Business Loans Lending For Small To Large Business Nab

Small Business Government Loans Grants Assist

2nd Round Of Queensland Small Business Covid 19 Grants Nexis

250k Loans Qld Government Tjn Accountants

Lean A3 Methode Het Oplossen Van Problemen Value Stream Mapping Analyse

Queensland Government Grants And Loans Tsra

How To Get A Business Loan Faqs Answers Moula

Court Orders Boq To Rewrite Unfair Small Business Contracts

What Is Small Business Financing Sme Finance Options Criskco

Queensland Government Grants And Loans Tsra

The Many Reasons To Own Vs Renting Finance Loans Mortgage Loans Refinance Loans

Small Business Government Loans Grants Assist

Business Loans Lending For Small To Large Business Nab

Hopping Around For Loans Is History Smartloans Loan Business Finance Small Business Loans

Posting Komentar untuk "Business Loans Queensland Government"