How To Report Excess Business Interest Expense From K-1

That form is used to compute the deductible amount of the excess. Client receives 1120-S K-1 with line 12-S 3100 Excess Business Interest Expense.

Learn How To Report And Pay Taxes On Your 1099 Income Income Tax Return Paying Taxes Income

Amounts reported in Box 13 Code K may be required to be reported on Form 8990 - Limitation on Business Interest Expense Under Section 163 j.

How to report excess business interest expense from k-1. So my question is what form to take the deduction. According to our CPE Vendor Taxspeaker Bob Jennings does not believe that any individual who grosses less than 25M needs to file Form 8990. The partner can consider such excess business interest to the extent of excess taxable income from that partnership.

Any business interest expense that exceeds the new Section 163 j limit is carried forward indefinitely. That is not where the deduction is taken. Excess business interest expense.

The expense is a separately stated item on the K-1 and must be entered manually. See Worksheet for Adjusting the Basis of a Partners Interest in the Partnership for additional information about computing the loss limitation. To indicate that the taxpayer is a small business taxpayer mark the Small business taxpayer field on Screen 8990 in the Schedule K folder.

Line 13K - Excess business interest expense - Amounts reported in Box 13 Code K represent a taxpayers share of business interest that was limited under the provisions of the Tax Cuts and Jobs Act. If there is no excess business interest expense in the return passed-through from another partnership marking the field will stop Form 8990 from printing. Without further guidance Im going to report on Sch E page 2 along with the other K-1 pass thru income.

You CAN File an 8990 If you had Line 20 AE Excess Taxable Income or Line 20 Code AF Excess Business Interest Income that is used to determine if YOUR return is subject to further limitations of Section 163j. IRS QA about limitation on deduction for business interest expense Question 15 says. In Part 1 line 1 youll take any other business interest expense you have reported on your other K-1s if you dont have any then that line will be zero.

A partners basis in the partnership is reduced but not below zero by excess business interest expense. UltraTax CS determines the amount of business interest deduction before other limitations by taking the lesser of excess business interest expense or the sum of excess taxable income and. See Form 8990 Limitation on Business Interest Expense Under Section 163j.

In many cases NONE of the K-1 recipients will be subject to the Section 163j limitation. If youre a regular taxpayer making less than 25 million from all your sources your likely not subject to the limitations but check all the conditions to be sure. Add those up on Line 5.

163 j and suspended excess business interest expense K-1 Ln 13K As most tax professionals know there were some tax law changes late December. For tax years beginning after 2017 the deduction for business interest expense cannot exceed the sum of the taxpayers. Any investor in a company that is subject to Section 163j limitations has further reporting requirements on his or her individual tax return.

163J Business Interest Expense Deduction K-1s 1040 partner received a K-1 from a 1065 PTP Calumet Specialty Partners showing loss in box 1 and 35K on line 13K Excess business interest expense. Excess business interest expense must be reported on Schedule K-1 so that the taxpayer knows how much to carry forward until they have ETI or excess business interest income to offset it. The modifications to Section 163 j apply to all businesses except those that are specifically exempt.

September 1 2019. Any excess business interest expense not deductible under section 163j will be included in box 13 code K for inclusion in the basis limitation and is not reported here. Enter the amount from the Form 1065 Schedule K-1.

GILTI The Global Intangible Low-Taxed Income GILTI provision in the TCJA was created to deter taxpayers from moving income-generating activities to low-taxed jurisdictions. Excess business interest passes through to the partner and reduces the partners basis in the partnership interest See instructions to 2020s Form. If you have any carry forwards from last years Form 8990 those go on line 2 and the current year excess business interest goes on Line 3.

There are five categories of exempt businesses. Among other things the 163 j rules were changes and youre allowed to use 50 ATI instead of 30 as well as 30-year ADS depreciation for property PIS pre-2018 instead of 40 as previously mandated. If a partner not subject to the section 163j limitation has excess business interest expense and is allocated excess taxable income or excess business interest income in a subsequent year the partner would file Form 8990 and the amount of excess business interest expense treated as paid or accrued in the current year would not be subject to further limitation under section 163j.

You may be surprised to see these disclosures on your K-1 because your company does NOT meet the above requirements. Section 163 j limitation is NOT allocated to its shareholder but is instead carried over at the S. S-Corp K-1 excess business interest expense.

Business interest income for the tax year. Line 20AF - Excess business interest - Amounts reported in Box 20 Code AF represent the business interest that was subject to a business interest limitation at the partnership level. 30 of adjusted taxable income ATI for the year or zero if the taxpayers ATI is less than zero.

Any excess business interest expense from a partnership is carryforward available to the partner not the partnership and can be used to offset excess taxable income or excess business interest income from that partnership in future years. Excess taxable income is the amount of adjusted taxable income of the partnership that was in excess of what it needed to deduct its business interest expense and excess business interest income is the amount by which business interest income exceeded business interest expense at the partnership level.

New Final Regulations Issued Under Sec 163 J Grant Thornton

Calculating Deductions For Business Interest Expense Mitchell Wiggins

Sample Budget Proposal Restaurant Cafe Bakery Sample Budget Budgeting Proposal

Calculating Deductions For Business Interest Expense Mitchell Wiggins

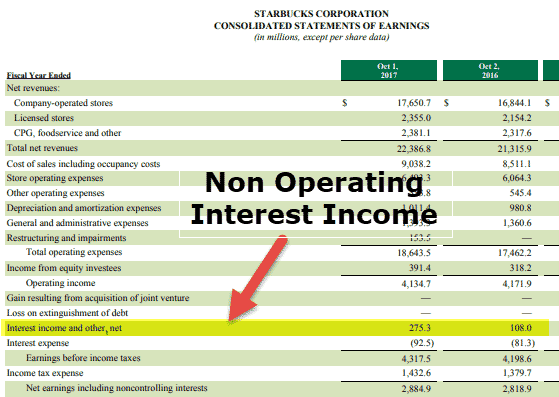

Interest Income Definition Example How To Account

Https Www Ftb Ca Gov Tax Pros Procedures Waters Edge Manual Chapter 12 Pdf

/GettyImages-951640954-03fb153a36a04d0490470839e3fb09e6.jpg)

Business Interest Expense Definition

How Do Operating Income And Revenue Differ

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

The Section 163 J Business Interest Expense Limitation 2021 Final Regulations Impact On Self Charged Interest For Partnerships Marcum Llp Accountants And Advisors

Income Statement Forecasting Guide Wall Street Prep

Cares Act Changes To The 2019 And 2020 Partnership Business Interest Expense Limitations Holthouse Carlin Van Trigt Llp

Instructions For Form 8990 05 2020 Internal Revenue Service

Income And Expenditure Account Definition Explanation Format And Example Accounting For Management Accounting Income Fund Accounting

Https Www Irs Gov Pub Newsroom Lbi Tcja Participant Guide 163j 13301 Pdf

Instructions For Form 8995 A 2020 Internal Revenue Service

163 J Package Implications For Passthrough Entities Kpmg United States

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Deloitte 2020 Interest Tracing Guide Pdf

Posting Komentar untuk "How To Report Excess Business Interest Expense From K-1"