Can Business Losses Offset Ordinary Income

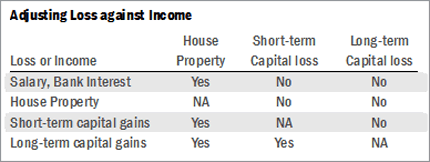

Tina is a passive investor in a partnership. Up to the annual limits you can use short-term capital losses to offset ordinary income after canceling out your other capital gains.

Your Queries Income Tax You Can Offset Long Term Capital Loss On Share Sale Against Any Ltcg The Financial Express

They cant be deducted from income you earn from a job or investments such as stock or savings accounts.

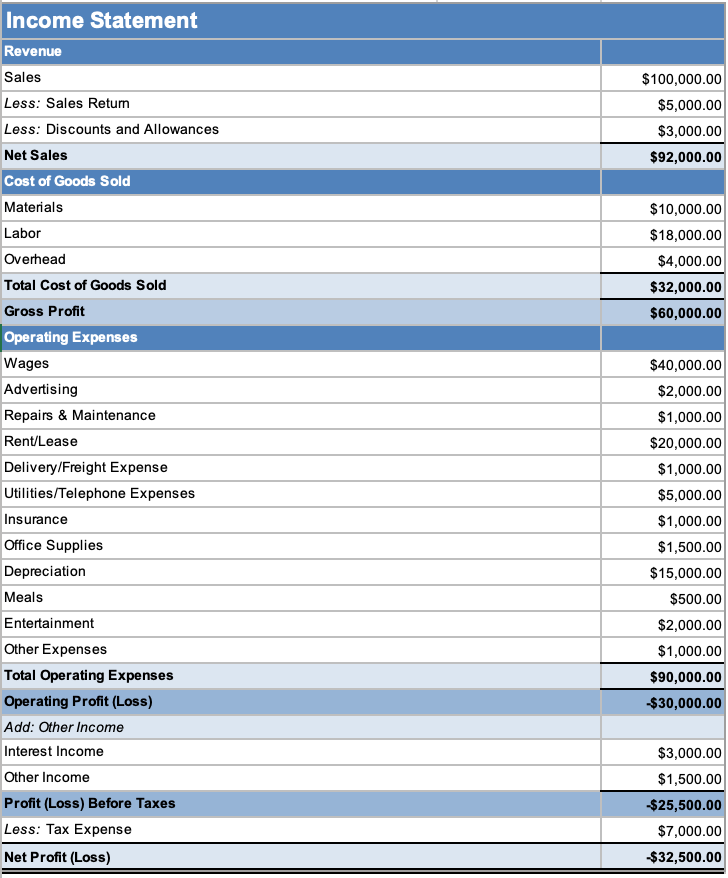

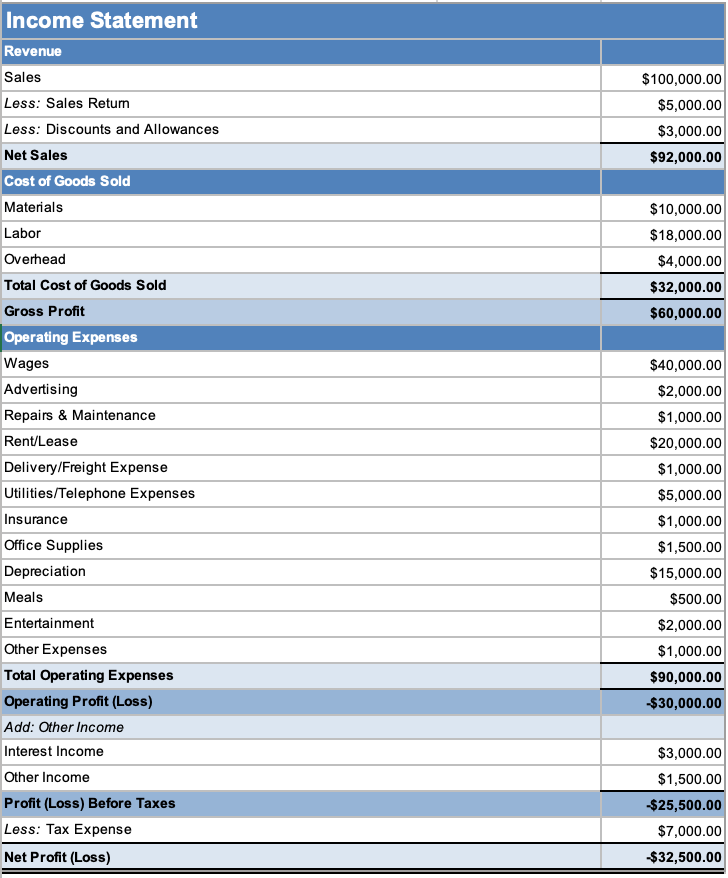

Can business losses offset ordinary income. See Pub 542 for more information and also the instructions for F1120. However some people use this to their advantage to reduce their taxable income from other sources such as from regular employment. Because the profit or loss from schedule F is included on your form 1040 it is a factor in calculating your income.

For a business can capital gains be offset by ordinary losses. And thats important when self-employment tax is involved. It will reduce his federal income tax liability but not the self employment tax due.

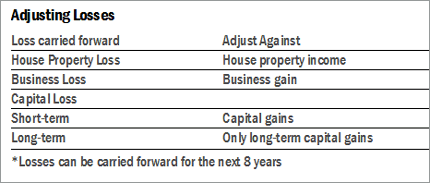

Unused passive losses are carried forward as such to offset passive income. This 3000 limit is based on a married couple where each receives a limit of 1500 or 3000 for the couple. Taking Business Tax Deductions.

You know that long-term losses can offset your ordinary income by no more than 3000 once you have no more capital gains to absorb these losses. The requirement that excess business losses must be carried forward as an NOL forces you to wait at least one year to get any tax benefit from those excess losses. Capital gains and losses are claimed on Schedule D.

For this reason should you experience a paper loss you may actually benefit from doing so. These schedules essentially separate each type of. Unused active losses can generally be carried backward for two years and forward for twenty years to offset active income.

Where a business starts up partway through a year the 20000 amount can be prorated. The practical impact is that your allowable current-year business losses cant offset more than 250000 of income from such other sources or more than 500000 for a married joint-filing couple. Yes The IRS allows taxpayers to write off the loss from a business on your personal tax return.

If he materially participates or is an active participant of the LLC his loss will still not be able to offset schedule c income for self employment purposes. This is a huge benefit as not only can the depreciation created losses be used to offset other ordinary income sources it can also directly impact a spouses W-2 wages. Under the first test the business must have an income of at least 20000 a year.

Business income and losses are claimed on Form 1040 Schedule C. The losses can also be claimed to offset gains at the 4me of sale of the equity interest. Although a business loss whether it is from a Schedule C business a partnership or S corporation can be used to reduce business income on your personal return its not as simple as offsetting a loss from a prior year against the business income for the current year.

So a 100000 in depreciation deductions can be used on the jointly filed tax. This greatly limits your ability to deduct them because passive losses can only be used to offset passive income. No only like losses can offset like income with very limited exceptions in which case these usually offset ordinary income.

If the amount of capital losses exceed capital gains up to 3000 of the excess can be used to offset any ordinary income. For more information please see. Example if you have a regular day job you can use the loss from a side business to offset your W2 or other income.

I have included instructions below on how to enter the information for your business in TurboTax. Passive income is the income you earn from rental real estate or other passive activities. Normally a capital loss in a stock can be used to offset any capital gains.

For an individual to offset business losses against other income such as salary and wages or investment income one of four tests must be passed. Passive activities such as rental property income and losses are claimed on Schedule E. Yes that should be correct.

However there are two ways to actually use those passive real estate losses against your ordinary income rather than waiting until you have enough rental income to use them. You also know that before year-end you can cherry-pick investments to sell at losses tax loss harvesting so you can offset your gains elsewhere in your portfolio. Those losses offset any long-term capital gains you may have and you can use 3000 per year against your ordinary income but after that they are simply carried over.

How To Offset Losses Against Paye As A Sole Trader Small Business

Reducing Tax Liability By Offsetting Losses Value Research

/GettyImages-932243540-5be86396c9e77c0051d2c714.jpg)

Business Related Ordinary Gains On Your Tax Return

How To Get Tax Gains From Your Losses Businesstoday

Set Off And Carry Forward Of Losses Amended Provisions From 2020 21

What Are The 2020 2021 Capital Gains Tax Rates Forbes Advisor

Carry Forward And Set Off Of Losses With Faqs

Reducing Tax Liability By Offsetting Losses Value Research

A Small Business Guide To Net Operating Loss The Blueprint

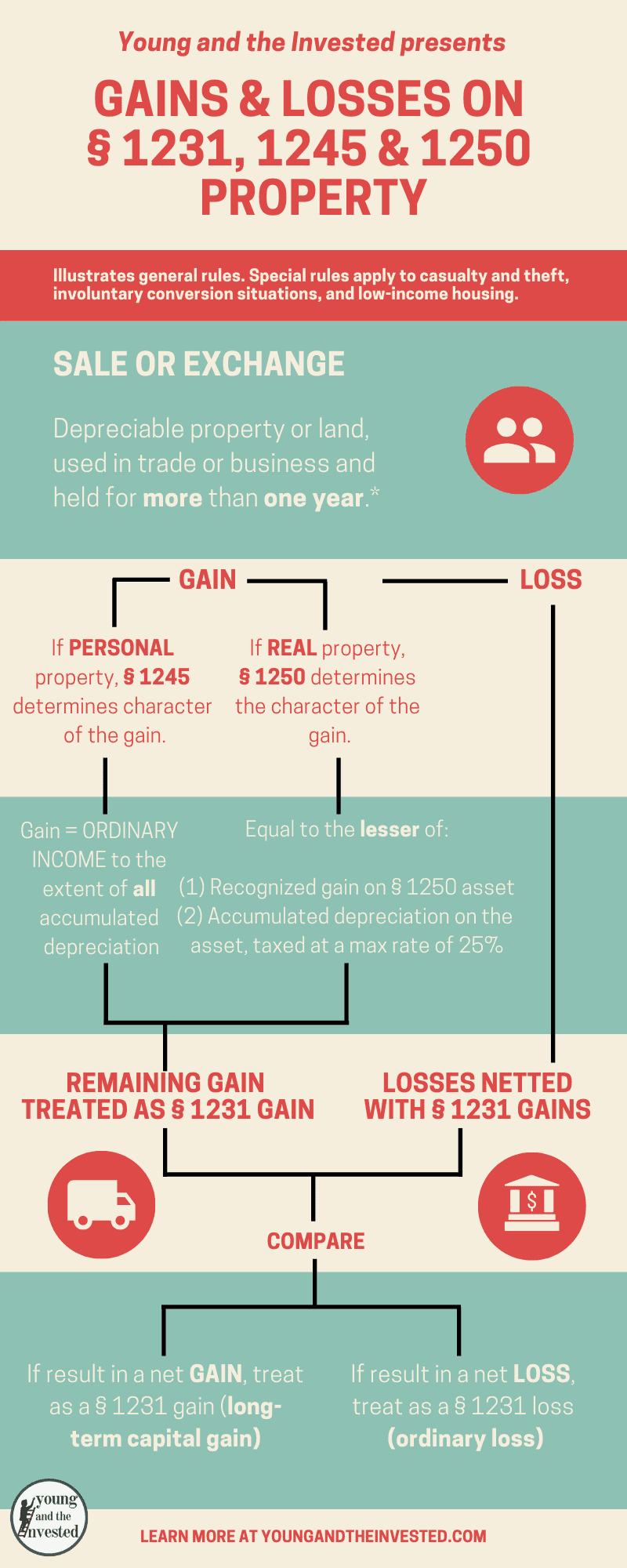

1231 1245 And 1250 Property Used In A Trade Or Business

Tax Query How Can I Set Off Business Loss Against Other Income Sources

Ordinary Income Definition Example Vs Capital Gains

Carry Forward And Set Off Of Losses With Faqs

How Do Capital Gains And Losses Affect Your Income Tax

Deducting Pass Through Business Losses

How To Offset Losses From Your Property Investment

How To Claim Business Losses Against Other Income Chan And Naylor

Posting Komentar untuk "Can Business Losses Offset Ordinary Income"