What Is K1 Tax Rate

Income credit deductions and other items. Individuals with taxable income below 80000 pay 0.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Part two will look at additional benefits provided through depreciation deductions and preferential tax rates on the sale of real property.

What is k1 tax rate. A marginal tax rate is the tax rate on income set at a higher rate for incomes above a designated higher bracket which in 2016 in the United States was 415050. These distributions are not what youre taxed on. Taxappeal168 Tax Accountant replied 6 months ago.

Now affiliate marketing aint that difficult as well as can make. Total taxes 26000. The Schedule K1 tax form indicates ones share of an estatetrust partnership or corporation.

I pay the employer half of payroll tax which is 75 7500. If you think or if a estate-planning expert you have engaged thinks the information in your. The K1 tax form signifies the transfer of tax responsibility from the person or company earning income to the one who actually benefits from it.

In terms of deductions or credits that can help reduce your tax liability for income inherited from an estate those can include things like. So they are taxed at different rates depending on the category of income just like any other income. An S corporation has two types of shareholders.

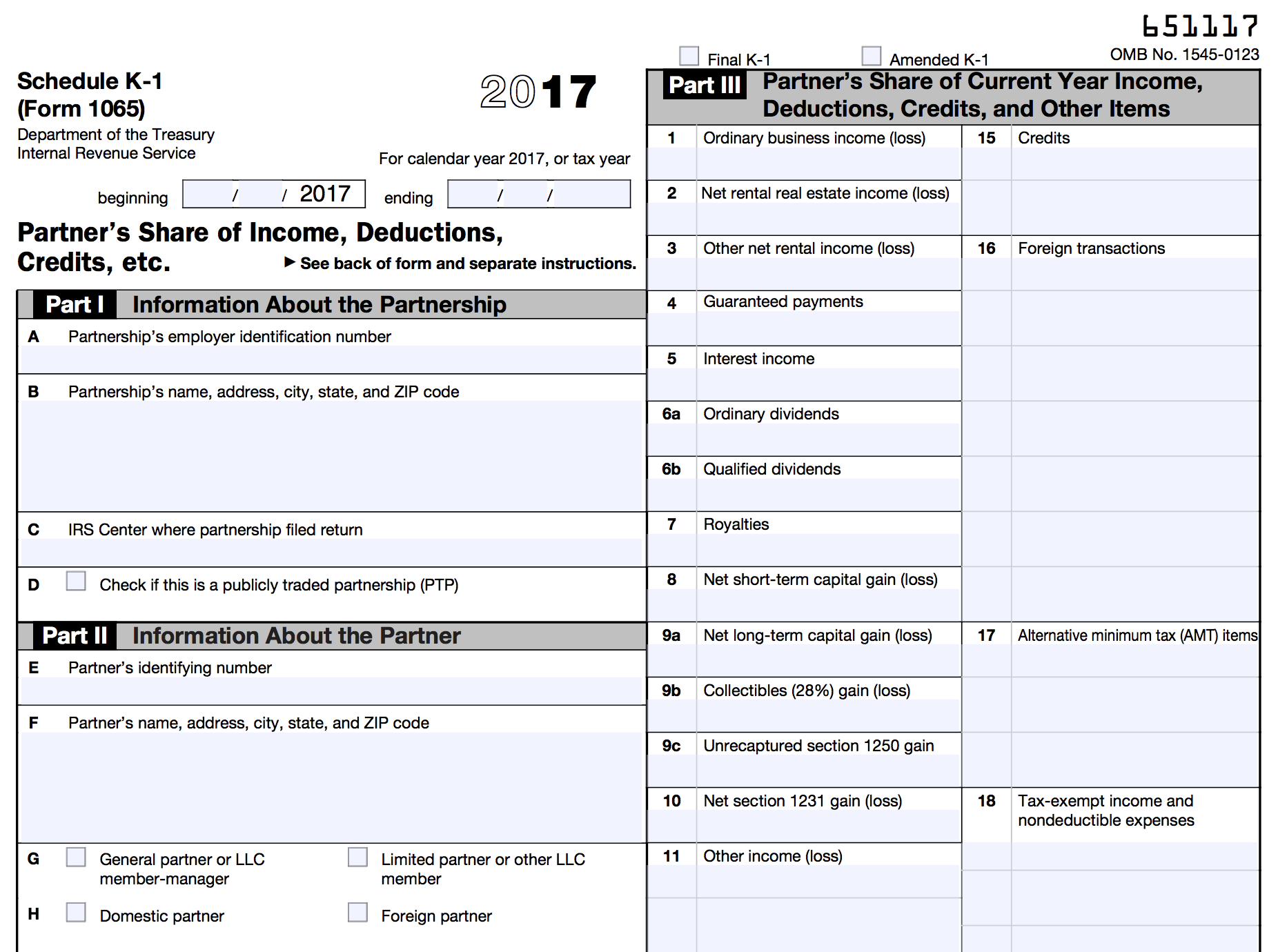

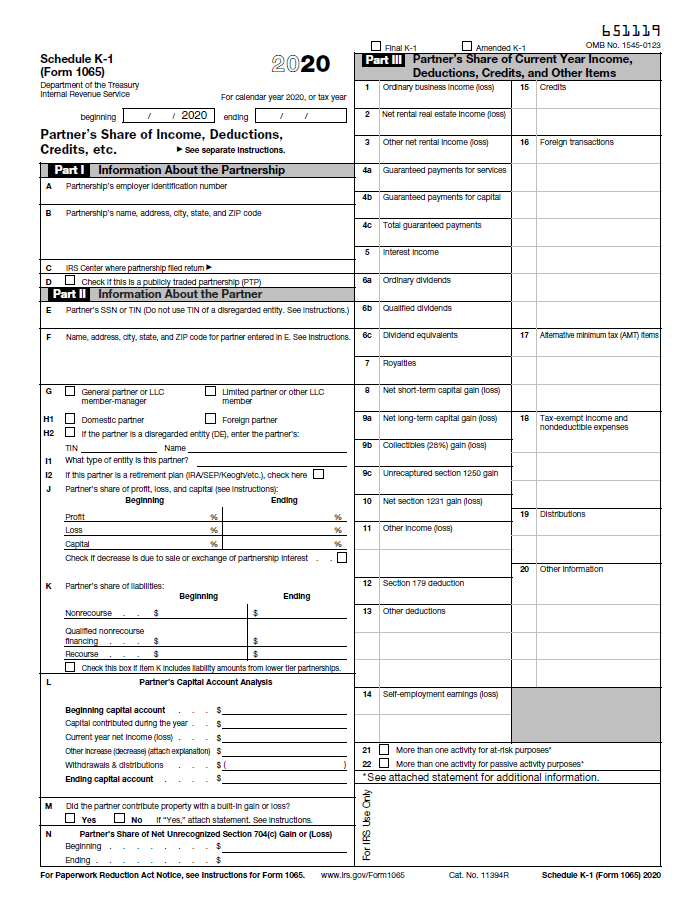

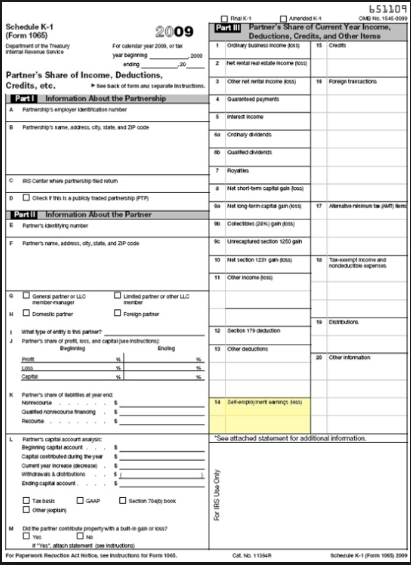

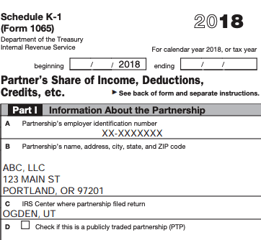

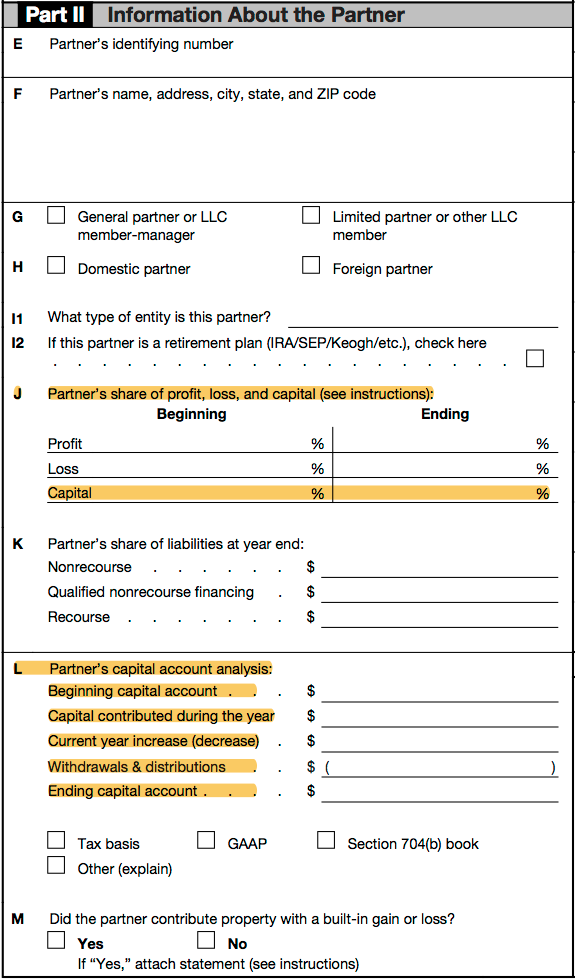

This share may come in any form. The purpose of Schedule K-1 is to report each partners share of the. Are k1 distributions taxable.

Will my tax rate be different this year. Under this system of. 3 decades of varied tax industry exp.

I receive a K1 every year. The ACA Net Investment Income Tax and payroll tax affect S corporations differently and therefore how S-corporation owners are taxed will vary. For income below the 415050 cut off the lower tax rate was 35 or less.

Start How is passive income k1 tax rate online business and make money online with this Online Business Affiliate Marketing Tutorial For Beginners Im most likely to reveal you affiliate marketing strictly for beginners below to start an online business and learn how to make money online. Individuals with taxable income between 80000 and 441450 pay 15 and investors with income above 441450 pay a 20 tax rate on capital. Under the TCJA the new rates are 10 12 22 24 32 35 and 37.

The upside is that when you report amounts from Schedule K-1 on your individual tax return you can benefit from lower tax rates for qualified dividends. There is no tax rate for K-1. 1 The other type of tax rate is the flat tax rate which a few states implement for state income tax.

Understanding Your Schedule K-1 and Real Estate Taxes. Ordinary income Boxes 1 2 3 5 6a and others will be added to your ordinary income and taxed at the rate for your tax brackets. I then pay 20 income tax on 100000 - 7500 20 x 92500 18500.

100k annual income paid via K1. There is an extra 118 percent marginal tax rate caused by Pease limitations on all itemized deductions. K1 distribution tax rate All Real Estate.

How is passive income k1 tax rate. Answered in 2 minutes by. Income Schedules K-1 and Rental.

What Is The K1 Tax Form. The K-1 lists distributions withdrawals from income or from your capital account that youve taken during the tax year. Volunteers who certify at the Advanced level are permitted to prepare a Schedule E Supplemental Income and Loss only with Schedule K-1 income items identified in this lesson or Form 1099-MISC Box 2 Royalties.

What tax codes are how theyre worked out and what to do if you think your code is wrong. Here is my understanding of how the taxes would work in each scenario. 100k annual income paid via W2.

Such as the potential to take tax-free distributions in years the LLC generates a tax loss. Ask Your Own Tax Question. You pay tax on your share of the LLCs income whether you withdraw it or keep it in the company.

Certain income from Schedules K-1 Forms 1065 1120S and 1041. Schedule K-1 is an Internal Revenue Service IRS tax form issued annually for an investment in partnership interests. For annual income that was above the cut off point in that higher bracket the marginal tax rate in 2016 was 396.

Understanding Your Schedule K-1 and Real Estate Taxes. The marginal tax rate on income can be.

Mlp Tax Guide Intelligent Income By Simply Safe Dividends

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts Jobs Act Smith And Howard Cpa

3 0 101 Schedule K 1 Processing Internal Revenue Service

Schedule K 1 Mlp Tax S Kathryn Kucera Cpa

Schedule K 1 Overview How It Works And Users

What Is A Schedule K 1 Form Zipbooks

What Is A Schedule K 1 Form Zipbooks

What Is A Schedule K 1 Form Zipbooks

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts Jobs Act Smith And Howard Cpa

Mlps And K 1s And Ubti Oh My Seeking Alpha

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

What Are The Tax Brackets H R Block

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

Https New Content Mortgageinsurance Genworth Com Documents Training Course Partnershipincome1065formk1 Presentation 0420 Pdf

Posting Komentar untuk "What Is K1 Tax Rate"